Case Study: A Profitable Position

Strong Leadership Includes Delegation to Subject Matter Experts

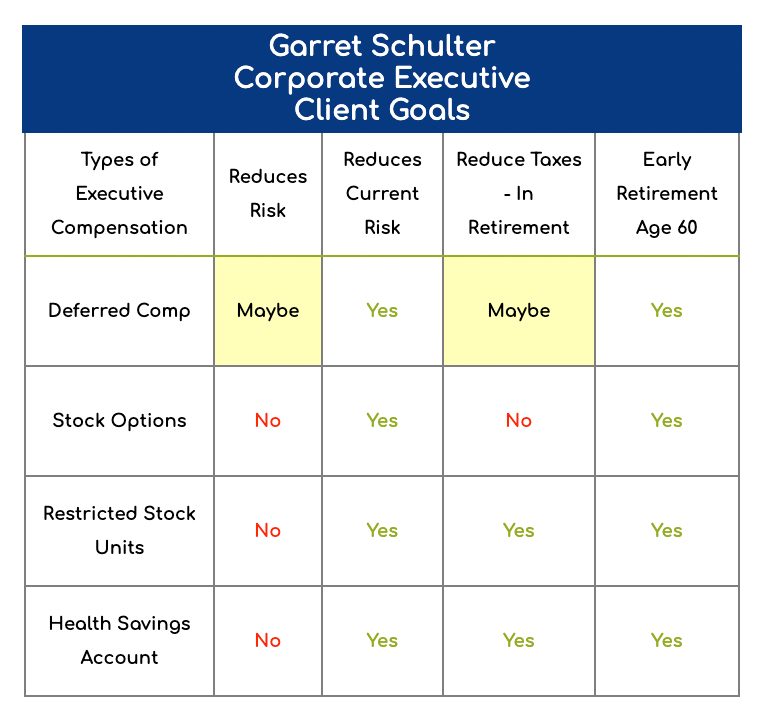

Garret Schulter was the Chief Clinical Officer for a fast growing medical technology company. After 3 years of receiving Restricted Stock, Stock Options and making Deferred Compensation elections, a meeting with Wealth Management Solutions (WMS) led to a conversation about how he made decisions to exercise the options and when to receive his deferred comp.

On his own, Garret had originally made four assumptions:

- He would hold each stock option grant until the last year before they expired

- The Restricted Stock Units would be held after they vested until they reached an analyst's price target

- Because he hoped to retire 5 years early at age 60, he would simply defer 40% of each year's bonus to be received as a lump sum payment when he was age 60.

- Garret was considering the best course of action for each benefit separately

In discussions with his executive peers, he received confirmation that they had structured their Deferred Comp in a similar manner. Garret's current Financial Advisor was unfamiliar with the tax consequences and did not feel comfortable providing any additional insight; mostly because he could not manage the assets with recommendations for his own investment products.

"Deferred Compensation is available as a perk to Select Executives.

If not used properly, and coordinated with other benefits, it can become a tax headache"

Multiple Complications Require a Watchmaker's Touch

- After meeting with WMS, Garret felt comfortable with our knowledge surrounding Executive Compensation, especially since the firm's Principal, David Rosenthal, had worked with many executives as a captive advisor for several Fortune 500 companies

- We analyzed his accounts, including his current income & tax situation, and were able to provide a detailed plan that significantly reduced his future tax accountability

- By coordinating the entire benefits package, this plan also reduced much of his risk surrounding the company stock

- Action: Review of assets exposes opportunities for consistent income and the right price for his stock options

- Simply deferring his bonus income to age 60 would have led income same tax bracket (or higher!) than when Garret was working

- By not understanding that there is an exact "right price" for stock options, he was putting this misunderstood benefit at substantial risk

C-Level Executive Advisor Services Stock Options Restricted Stock

Results: Looking at the Total Package

At Wealth Management Solutions, we have worked exclusively with Fortune 500 company executives to implement complicated Executive Compensation plans in coordination with a client's trusted tax advisor. Our advice strategies surrounding Stock Options, Restricted Stock, Deferred Compensation, and use of Qualified & Non-Qualified Retirement Plans can lead to substantial tax benefits. Ultimately, it may also result in more income for the Executive and their family, while at the same time reducing their risk.

Case Study: A Profitable Position

Strong Leadership Includes Delegation to Subject Matter Experts

Garret Schulter was the Chief Clinical Officer for a fast growing medical technology company. After 3 years of receiving Restricted Stock, Stock Options and making Deferred Compensation elections, a meeting with Wealth Management Solutions (WMS) led to a conversation about how he made decisions to exercise the options and when to receive his deferred comp.

On his own, Garret had originally made four assumptions:

- He would hold each stock option grant until the last year before they expired

- The Restricted Stock Units would be held after they vested until they reached an analyst's price target

- Because he hoped to retire 5 years early at age 60, he would simply defer 40% of each year's bonus to be received as a lump sum payment when he was age 60.

- Garret was considering the best course of action for each benefit separately

In discussions with his executive peers, he received confirmation that they had structured their Deferred Comp in a similar manner. Garret's current Financial Advisor was unfamiliar with the tax consequences and did not feel comfortable providing any additional insight; mostly because he could not manage the assets with recommendations for his own investment products.

Deferred Compensation is available as a perk to Select Executives. If not used properly, and coordinated with other benefits, it can become a tax headache.

Multiple Complications Require a Watchmaker's Touch

- After meeting with WMS, Garret felt comfortable with our knowledge surrounding Executive Compensation, especially since the firm's Principal, David Rosenthal, had worked with many executives as a captive advisor for several Fortune 500 companies

- We analyzed his accounts, including his current income & tax situation, and were able to provide a detailed plan that significantly reduced his future tax accountability

- By coordinating the entire benefits package, this plan also reduced much of his risk surrounding the company stock

- Action: Review of assets exposes opportunities for consistent income and the right price for his stock options

- Simply deferring his bonus income to age 60 would have led income same tax bracket (or higher!) than when Garret was working

- By not understanding that there is an exact "right price" for stock options, he was putting this misunderstood benefit at substantial risk

Results: Looking at the Total Package

At Wealth Management Solutions, we have worked exclusively with Fortune 500 company executives to implement complicated Executive Compensation plans in coordination with a client's trusted tax advisor. Our advice strategies surrounding Stock Options, Restricted Stock, Deferred Compensation, and use of Qualified & Non-Qualified Retirement Plans can lead to substantial tax benefits. Ultimately, it may also result in more income for the Executive and their family, while at the same time reducing their risk.

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed