Case Study: A Young Man Inherits His Share

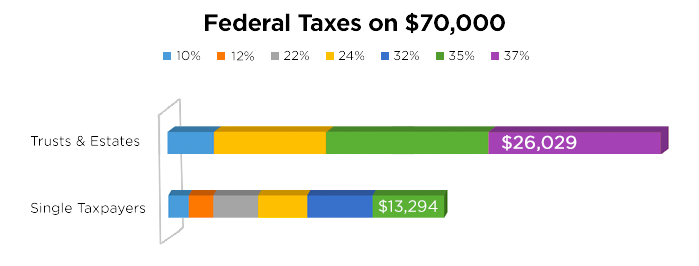

Income of $70,000 leads to a 45% tax hit

We were introduced to Michael Wilder, a 34 year old who had inherited his share of his grandparent’s estate within the last year. Under the ownership of his Grandfather Russ Wilder, the portfolio held mostly Master Limited Partnerships (MLP’s) which provided a stream of income in retirement. Obviously, this had not been the entirety of Michael’s grandfather’s holdings, but this was the account and portion that Michael had inherited – close to $1.5Million..

If only I could pass on the Financial Knowledge instead of the money,

my heirs would be better off.

Lacking in the knowledge and experience of his Grandfather, Michael continued to hold these individual stocks and receive the quarterly income into the Trust account. Michael planned to use a portion of the Trust to pay off multiple debts and was interested in returning to college. Recognizing that even small amounts of income within an Irrevocable Trust result in payments to the IRS at the highest tax bracket,Wealth Management Solutions knew that any recommendations would require some changes to either the portfolio, the distributions, or both.

Strategy: Examination of positions exposes shortfalls, and opportunities for realignment

The initial meetings focused on a thorough review of the Michael’s goals and expectations for maintaining and using the windfall he had inherited. Our analysis found the following problem areas:

- Lack of diversification of the assets

- No knowledge or understanding of the tax consequences of the investments

- Large annual tax burden based on how the income was received

- Lack of understanding regarding the risk of the investments

- Uncertainty about provisions of the Trust document

Michael’s inheritance was providing $70,000 of income each year, but because it was retained within the Irrevocable Trust, this was subject to the highest marginal tax bracket. Had he simply moved the income to his own personal account, Michael could have saved $13,000 a year in taxes!

Action: The Right Investment for the Right Client

Following our consultation, Michael Wilder took the following recommendations to improve his inheritance and greatly reduce his tax burden:

- A plan to distribute all income from the Trust to avoid the highest tax bracket of 39.6%

- Estate planning strategies were instituted to provide a plan for coordinating his wealth and passing it on to his own future heirs

- Unsure of how much he could draw from the account on an annual basis, a comprehensive analysis was conducted to determine what cash flow would be needed to achieve Michael’s goals

- Beneficial tax strategies were presented to Michael including the option to sell the assets which would result in a step up in cost basis

Unfortunately, the market had recently driven the value of his concentrated account down significantly. We worked quickly with Michael to determine his risk profile, and implement a diversified portfolio of low expense mutual funds that would allow for reasonable growth along with a plan to provide income from the portfolio for his near term needs.

Review: Windfall of Wealth doesn’t have to be “A Blessing and a Curse”

Wealth Management Solutions assisted this young man with options to improve his portfolio, and substantially decrease his tax burden. Our client was thankful that we stepped in before his portfolio continued to drop, and before he encountered a completely unforeseen tax burden the following year. We like to think Michael’s grandfather would be pleased that his grandson encountered a sage advisor in the form of Wealth Management Solutions. What Michael now knows is, the wisdom of a great advisor can provide him the same opportunity to pass on the knowledge

Case Study: A Young Man Inherits His Share

Income of $70,000 leads to a 45% tax hit

We were introduced to Michael Wilder, a 34 year old who had inherited his share of his grandparent’s estate within the last year. Under the ownership of his Grandfather Russ Wilder, the portfolio held mostly Master Limited Partnerships (MLP’s) which provided a stream of income in retirement. Obviously, this had not been the entirety of Michael’s grandfather’s holdings, but this was the account and portion that Michael had inherited – close to $1.5Million..

If only I could pass on the Financial Knowledge instead of the money, my heirs would be better off.

Lacking in the knowledge and experience of his Grandfather, Michael continued to hold these individual stocks and receive the quarterly income into the Trust account. Michael planned to use a portion of the Trust to pay off multiple debts and was interested in returning to college. Recognizing that even small amounts of income within an Irrevocable Trust result in payments to the IRS at the highest tax bracket,Wealth Management Solutions knew that any recommendations would require some changes to either the portfolio, the distributions, or both.

Strategy: Examination of positions exposes shortfalls, and opportunities for realignment

The initial meetings focused on a thorough review of the Michael’s goals and expectations for maintaining and using the windfall he had inherited. Our analysis found the following problem areas:

- Lack of diversification of the assets

- No knowledge or understanding of the tax consequences of the investments

- Large annual tax burden based on how the income was received

- Lack of understanding regarding the risk of the investments

- Uncertainty about provisions of the Trust document

Michael’s inheritance was providing $70,000 of income each year, but because it was retained within the Irrevocable Trust, this was subject to the highest marginal tax bracket. Had he simply moved the income to his own personal account, Michael could have saved $13,000 a year in taxes!

Action: The Right Investment for the Right Client

Following our consultation, Michael Wilder took the following recommendations to improve his inheritance and greatly reduce his tax burden:

- A plan to distribute all income from the Trust to avoid the highest tax bracket of 39.6%

- Estate planning strategies were instituted to provide a plan for coordinating his wealth and passing it on to his own future heirs

- Unsure of how much he could draw from the account on an annual basis, a comprehensive analysis was conducted to determine what cash flow would be needed to achieve Michael’s goals

- Beneficial tax strategies were presented to Michael including the option to sell the assets which would result in a step up in cost basis

Unfortunately, the market had recently driven the value of his concentrated account down significantly. We worked quickly with Michael to determine his risk profile, and implement a diversified portfolio of low expense mutual funds that would allow for reasonable growth along with a plan to provide income from the portfolio for his near term needs.

Review: Windfall of Wealth doesn’t have to be “A Blessing and a Curse”

Wealth Management Solutions assisted this young man with options to improve his portfolio, and substantially decrease his tax burden. Our client was thankful that we stepped in before his portfolio continued to drop, and before he encountered a completely unforeseen tax burden the following year. We like to think Michael’s grandfather would be pleased that his grandson encountered a sage advisor in the form of Wealth Management Solutions. What Michael now knows is, the wisdom of a great advisor can provide him the same opportunity to pass on the knowledge

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed