Case Study: A Medical Sales Business Sold

Rethinking Home Ownership Leaves Less to Worry About

Ben Miller left his job working for a hospital to become an entrepreneur and create a wholesale medical sales business. A friend of Ben’s had started a similar business and mentored him when he started the company 9 years ago. Ben’s three children expressed no interest in running the business, and he had a potential buyer with an offer in hand. He came to Wealth Management Solutions initially looking for Investment guidance for the sale proceeds from an offer to purchase his business. Ben planned to pay off multiple debts and was interested in investment management with the remainder of his assets. Recognizing that the goals of the individual would be a key driver to the ultimate success, we knew that any recommendations would require some creative thinking to find the right solution.

“What Wealth Management Solutions does, is not the storyline here.

Enabling Ben to be confident with his decision to sell and achieve his goals, is the ultimate headline” - David Rosenthal, WMS Principal / Owner

Strategy: Examination exposes shortfalls, and opportunities for realignment

The initial meetings focused on a thorough review of Ben’s goals and expectations of his lifestyle after owning and running a successful business. Our analysis found the following problem areas:

- No cohesive strategy for the tax consequences from the sale

- Potential liability from owning the building in his personal trust after the sale – a need to have a separate LLC that owns the building

- A lack of liquid assets after paying off debt

- Long-term shortfalls forcing a return to work as a result of overspending, instead of the choice to start another business at some point in the future

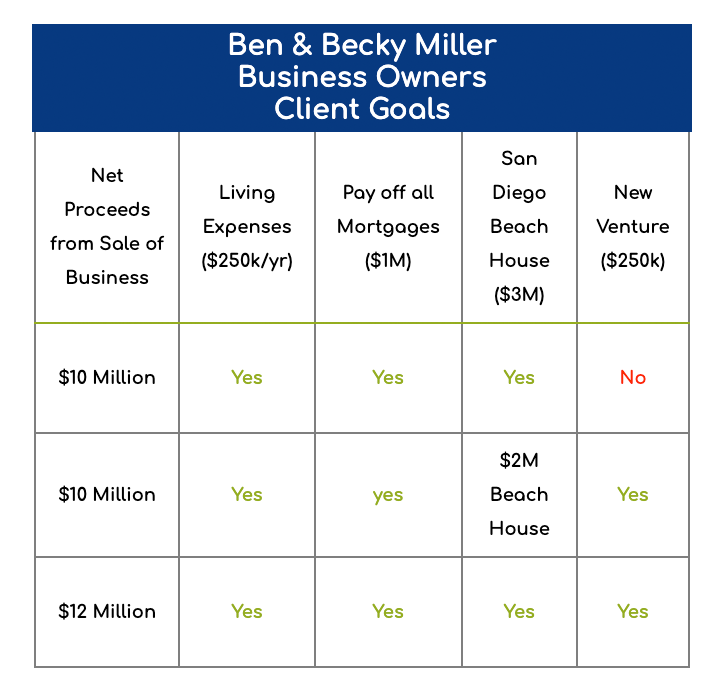

With a current offer that would net $10 Million for his Medical Sales business, Ben might not be able to achieve all of his goals after the sale. By either increasing the value in the business for a future sale, or rethinking the necessity of his less important goals, Ben now had additional clarity regarding the offer for his business.

Business Financial Planner helping owners with succession planning

Action: A Decision to Retire Early, the Confidence to Proceed

Following the consultation, our client took the following recommendations to improve their position for the business and their future:

- A comprehensive analysis was conducted to determine what value would be needed to sell the business to achieve his goals

- Beneficial tax strategies were presented to the client including the options of an asset sale vs. a stock sale

- The title of the building was transferred to Ben’s newly formed LLC to mitigate personal risk

- Estate planning strategies were instituted before sale of the business was initiated to transfer assets to heirs

Investment management included portfolio design with low expense investment options that would meet his annual income needs of $250,000. Since he would no longer participate in his company’s health insurance plan, we worked with third party professionals to provide insurance coverage for Ben’s family.

Review: Outcome “Surpassed Expectations”

Wealth Management Solutions assisted Ben Miller with options to bridge the gap between an offer on the table, and his dreams of retiring at his beachside property. Ben’s initial need appeared straightforward; However, WMS found hidden opportunities that will benefit the Millers for generations.

Case Study: A Medical Sales Business Sold

Rethinking Home Ownership Leaves Less to Worry About

Ben Miller left his job working for a hospital to become an entrepreneur and create a wholesale medical sales business. A friend of Ben’s had started a similar business and mentored him when he started the company 9 years ago. Ben’s three children expressed no interest in running the business, and he had a potential buyer with an offer in hand. He came to Wealth Management Solutions initially looking for Investment guidance for the sale proceeds from an offer to purchase his business. Ben planned to pay off multiple debts and was interested in investment management with the remainder of his assets. Recognizing that the goals of the individual would be a key driver to the ultimate success, we knew that any recommendations would require some creative thinking to find the right solution.

What Wealth Management Solutions does, is not the storyline here. Enabling Ben to be confident with his decision to sell and achieve his goals, is the ultimate headline.

David Rosenthal, WMS Principal / Owner

Strategy: Examination exposes shortfalls, and opportunities for realignment

The initial meetings focused on a thorough review of Ben’s goals and expectations of his lifestyle after owning and running a successful business. Our analysis found the following problem areas:

- No cohesive strategy for the tax consequences from the sale

- Potential liability from owning the building in his personal trust after the sale – a need to have a separate LLC that owns the building

- A lack of liquid assets after paying off debt

- Long-term shortfalls forcing a return to work as a result of overspending, instead of the choice to start another business at some point in the future

With a current offer that would net $10 Million for his Medical Sales business, Ben might not be able to achieve all of his goals after the sale. By either increasing the value in the business for a future sale, or rethinking the necessity of his less important goals, Ben now had additional clarity regarding the offer for his business.

Action: A Decision to Retire Early, the Confidence to Proceed

Following the consultation, our client took the following recommendations to improve their position for the business and their future:

- A comprehensive analysis was conducted to determine what value would be needed to sell the business to achieve his goals

- Beneficial tax strategies were presented to the client including the options of an asset sale vs. a stock sale

- The title of the building was transferred to Ben’s newly formed LLC to mitigate personal risk

- Estate planning strategies were instituted before sale of the business was initiated to transfer assets to heirs

Investment management included portfolio design with low expense investment options that would meet his annual income needs of $250,000. Since he would no longer participate in his company’s health insurance plan, we worked with third party professionals to provide insurance coverage for Ben’s family.

Review: Outcome “Surpassed Expectations”

Wealth Management Solutions assisted Ben Miller with options to bridge the gap between an offer on the table, and his dreams of retiring at his beachside property. Ben’s initial need appeared straightforward; However, WMS found hidden opportunities that will benefit the Millers for generations.

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed