Case Study: A New Beginning

Rethinking Home Ownership Leaves Less to Worry About

Danni Robinson was a “50 something” soon-to-be divorcee. Because her husband had earned and managed a majority of their income while they were married, she wisely sought the help of an independent advisor in the form of Wealth Management Solutions. Beyond the financials of splitting the assets, she would need a plan for purchasing and furnishing a new residence, caring for their children, and the next chapter in her life. Danni also wasn’t sure if she could even afford to buy and take care of the maintenance of a new home.

Fear of the Unknown Can Distract from a Positive Outcome

Initial meetings focused on a thorough review of Danni’s goals and expectations for life after marriage. Our analysis found the following needs:

- No immediate strategy for how to split the assets including a home, investments, and her husband’s deferred compensation and pension plans

- A need to update legal documents including Trusts, Insurance, and beneficiaries of accounts

- Concern for the divorce settlement lasting for the long-term

- Tax changes: How and when to file separately and a need to project tax consequences for a change in filing status

I am strong enough to make this change,

but that doesn't mean I am not uncertain about what the outcome will be.

Action: Review of assets exposes opportunities for a win-win situation

Following our consultation, our client took the following recommendations to improve their position for their family and their future:

Phase I

- A review of the community property assets and her husband’s compensation plan led to a discovery that there was more available to her than she had been aware of.

- Beneficial tax strategies were presented to the client:

-Allowing her husband to claim a large business loss on his next year’s tax return was of such a benefit that he was willing to distribute more assets to her in exchange

-With his subsequent future income placing him well into the highest tax bracket, the husband’s $400,000 pension was actually worth more to Danni, than their $400,000 in taxable investments - Guidelines for care of the children, purchases of their first vehicles, and payment for college were outlined in advance of divorce mediation meetings

- Estate planning strategies were instituted before the divorce was initiated so that transfer of assets would remain with their children, even in the event of remarriage

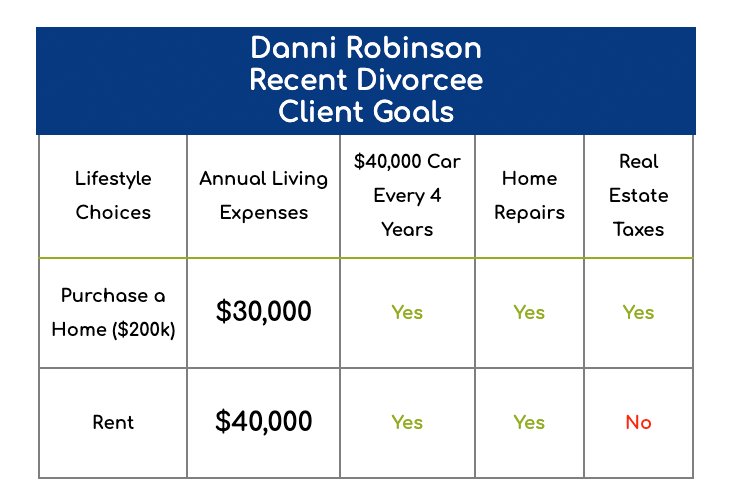

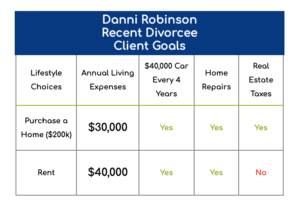

- A review and decision about whether to purchase a new home, or renting a larger space

Phase II

Because the assets Danni received as a result of the divorce decree were lopsided toward higher risk investments, Wealth Management Solutions initiated a more appropriate asset allocation for her more conservative nature. We also were able to reduce the fees well below the 2.5% she and her husband had been paying at their old advisor.

By reviewing and updating beneficiary information on accounts, Danni could be assured that assets would not revert to her ex-husband and his new family.

Results: “A New Partner” in My Life

Wealth Management Solutions assisted a divorcee, along with her divorce mediator, toward a much more amicable, and financially positive outcome than either party had considered at the start of divorce filing. Our client’s initial need was for assurances and assistance, which involved a frank conversation around her cash flow going forward. But in the end, she ended up with a new partner, who continues to have her financial best interest in mind whenever they meet.

Case Study: A New Beginning

Rethinking Home Ownership Leaves Less to Worry About

Danni Robinson was a “50 something” soon-to-be divorcee. Because her husband had earned and managed a majority of their income while they were married, she wisely sought the help of an independent advisor in the form of Wealth Management Solutions. Beyond the financials of splitting the assets, she would need a plan for purchasing and furnishing a new residence, caring for their children, and the next chapter in her life. Danni also wasn’t sure if she could even afford to buy and take care of the maintenance of a new home.

Fear of the Unknown Can Distract from a Positive Outcome

Initial meetings focused on a thorough review of Danni’s goals and expectations for life after marriage. Our analysis found the following needs:

- No immediate strategy for how to split the assets including a home, investments, and her husband’s deferred compensation and pension plans

- A need to update legal documents including Trusts, Insurance, and beneficiaries of accounts

- Concern for the divorce settlement lasting for the long-term

- Tax changes: How and when to file separately and a need to project tax consequences for a change in filing status

I am strong enough to make this change, but that doesn’t mean I am not uncertain about what the outcome will be.

Action: Review of assets exposes opportunities for a win-win situation

Following our consultation, our client took the following recommendations to improve their position for their family and their future:

Phase I

- A review of the community property assets and her husband’s compensation plan led to a discovery that there was more available to her than she had been aware of.

- Beneficial tax strategies were presented to the client:

-Allowing her husband to claim a large business loss on his next year’s tax return was of such a benefit that he was willing to distribute more assets to her in exchange

-With his subsequent future income placing him well into the highest tax bracket, the husband’s $400,000 pension was actually worth more to Danni, than their $400,000 in taxable investments - Guidelines for care of the children, purchases of their first vehicles, and payment for college were outlined in advance of divorce mediation meetings

- Estate planning strategies were instituted before the divorce was initiated so that transfer of assets would remain with their children, even in the event of remarriage

- A review and decision about whether to purchase a new home, or renting a larger space

Phase II

Because the assets Danni received as a result of the divorce decree were lopsided toward higher risk investments, Wealth Management Solutions initiated a more appropriate asset allocation for her more conservative nature. We also were able to reduce the fees well below the 2.5% she and her husband had been paying at their old advisor.

By reviewing and updating beneficiary information on accounts, Danni could be assured that assets would not revert to her ex-husband and his new family.

Results: “A New Partner” in My Life

Wealth Management Solutions assisted a divorcee, along with her divorce mediator, toward a much more amicable, and financially positive outcome than either party had considered at the start of divorce filing. Our client’s initial need was for assurances and assistance, which involved a frank conversation around her cash flow going forward. But in the end, she ended up with a new partner, who continues to have her financial best interest in mind whenever they meet.

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed