Case Study: Shifting Gears Into Retirement

A Couple Finds Wealth and Happiness Close to Home

Tom & Elizabeth Sherwood contacted Wealth Management Solutions in May of 2015. Tom was a Director of Technology for a large bank and Elizabeth worked for the Arizona Diamondbacks back office as a travel coordinator. Tom and Elizabeth were about to retire, and they needed help with the 401(k) accounts they had saved up for the last 20 years. Spending time with their children, and their grandchildren, was beginning to be much more attractive than heading into work each day.

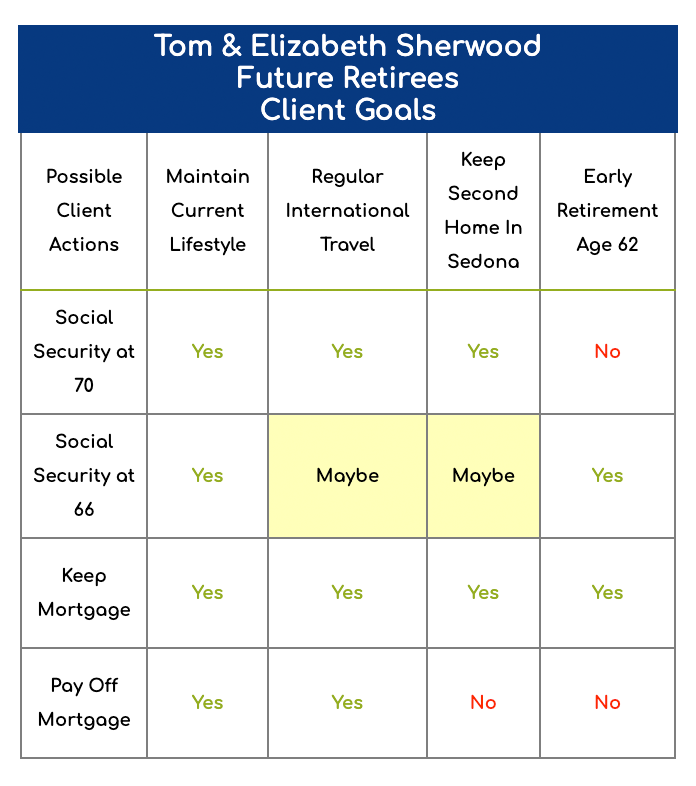

Now that Tom and Elizabeth were at retirement's doorstep, they had been thinking about all of the changes and choices available to them when they stopped working. The four main issues they needed guidance with included possibly paying off their mortgage, maintaining their current lifestyle, travel more often now that their schedules were freed up, and possibly keeping their second home - at least for a few more years.

From what I've been reading, I should just wait until age 70 to take Social Security, right?

Tom Sherwood was used to doing his own investment research, so he had already looked into how to draw Social Security during retirement. "From what I've been reading, I should just wait until age 70 to take Social Security, right?" By sharing a Social Security strategy with Tom & Elizabeth, our team at WMS showed a way to potentially receive an additional $60,000 from Social Security before Elizabeth even turns 70. Obviously, this helped them feel much more secure retiring in two years and spending more time traveling in Italy and the rest of Europe.

Regarding the mortgage, the Sherwood’s still owed $170,000 on their primary residence. With a mortgage interest rate slightly below 4%, leaving their money invested and earning more than 4% after tax annually made sense from an opportunity cost standpoint. However, as an experienced advisor, we have seen time and again that there is a distinct change in a client's frame of mind at retirement when they no longer see a paycheck deposited into their bank account. For this reason, we know that the emotional decision not to write a check to the bank for the mortgage every month far exceeded the financial benefit of keeping those assets invested.

... the emotional decision not to write a check to the bank for the mortgage every month, far exceeded the financial benefit of keeping those assets invested.

Ultimately, Wealth Management Solutions considered and calculated the goals, needs, wants, and desires that Tom & Elizabeth Sherwood had for the "life after work" they called retirement. At our follow up meeting, we were able to show concrete numbers and scenarios whereby they could achieve all of their most important goals. This led to a satisfaction that they could let go of the reins, and finally be done with the daily grind.

As Investment Advisors, we are used to sharing advice and our experience with prospective clients. Tom surprised us by asking if he could share some of his own: "When our kids were born, we bought a small house up north - close enough to get away on weekends. We always thought we would sell it when our children went to college, but we've held on to it. To tell you the truth, if you look at our account balances, I can honestly tell you that the memories we made as a family by getting away together, are worth much more than our savings in those accounts." It was an insight that guided our financial planning with the Sherwood family from that day forward.

Case Study: Shifting Gears Into Retirement

A Couple Finds Wealth and Happiness Close to Home

Tom & Elizabeth Sherwood contacted Wealth Management Solutions in May of 2015. Tom was a Director of Technology for a large bank and Elizabeth worked for the Arizona Diamondbacks back office as a travel coordinator. Tom and Elizabeth were about to retire, and they needed help with the 401(k) accounts they had saved up for the last 20 years. Spending time with their children, and their grandchildren, was beginning to be much more attractive than heading into work each day.

Now that Tom and Elizabeth were at retirement's doorstep, they had been thinking about all of the changes and choices available to them when they stopped working. The four main issues they needed guidance with included possibly paying off their mortgage, maintaining their current lifestyle, travel more often now that their schedules were freed up, and possibly keeping their second home - at least for a few more years.

From what I've been reading, I should just wait until age 70 to take Social Security, right?

Tom Sherwood was used to doing his own investment research, so he had already looked into how to draw Social Security during retirement. "From what I've been reading, I should just wait until age 70 to take Social Security, right?" By sharing a Social Security strategy with Tom & Elizabeth, our team at WMS showed a way to potentially receive an additional $60,000 from Social Security before Elizabeth even turns 70. Obviously, this helped them feel much more secure retiring in two years and spending more time traveling in Italy and the rest of Europe.

Regarding the mortgage, the Sherwood’s still owed $170,000 on their primary residence. With a mortgage interest rate slightly below 4%, leaving their money invested and earning more than 4% after tax annually made sense from an opportunity cost standpoint. However, as an experienced advisor, we have seen time and again that there is a distinct change in a client's frame of mind at retirement when they no longer see a paycheck deposited into their bank account. For this reason, we know that the emotional decision not to write a check to the bank for the mortgage every month far exceeded the financial benefit of keeping those assets invested.

... the emotional decision not to write a check to the bank for the mortgage every month, far exceeded the financial benefit of keeping those assets invested.

Ultimately, Wealth Management Solutions considered and calculated the goals, needs, wants, and desires that Tom & Elizabeth Sherwood had for the "life after work" they called retirement. At our follow up meeting, we were able to show concrete numbers and scenarios whereby they could achieve all of their most important goals. This led to a satisfaction that they could let go of the reins, and finally be done with the daily grind.

As Investment Advisors, we are used to sharing advice and our experience with prospective clients. Tom surprised us by asking if he could share some of his own: "When our kids were born, we bought a small house up north - close enough to get away on weekends. We always thought we would sell it when our children went to college, but we've held on to it. To tell you the truth, if you look at our account balances, I can honestly tell you that the memories we made as a family by getting away together, are worth much more than our savings in those accounts." It was an insight that guided our financial planning with the Sherwood family from that day forward.

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed