Case Study: The Widow Tax™

Spousal Loss leads to an Overbearing Uncle Sam

John & Sarah Raymond were retiring this year. John worked as the lead architect at a mid-sized firm for much of his career, and Sarah was a librarian at the high school their children attended and graduated from when they were younger.

When we met with the Raymonds, our initial meeting progressed as many do with an introduction to our firm and our staff, a discussion of the Wealth Management Solutions Investment Philosophy, and a request for insight into John & Sarah’s goals for retirement. After talk of travel and more time with grandkids, John became silent and paused to reflect on a concern that weighed heavily on his mind. Would Sarah be okay, financially, after he passed away?

Sarah would be able to have the same, if not more income at retirement.

In addition to the $35,000 annual income from Social Security, John & Sarah also received $36,000 in annual income as a result of rental property they own and from dividends & interest from their taxable accounts. With John being 65 and Sarah only 58, they did not yet need to begin taking required minimum distributions from their IRAs. John believed Sarah would receive a reduced amount of Social Security if he died first.

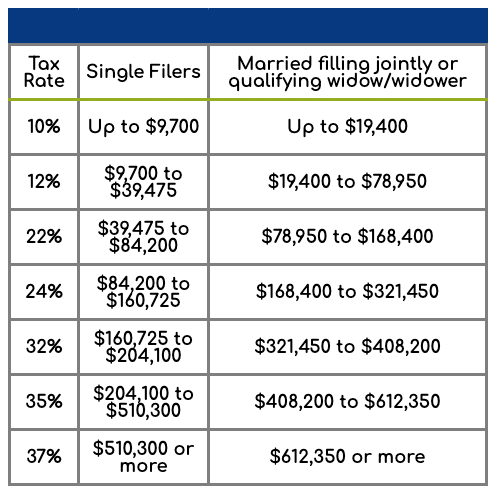

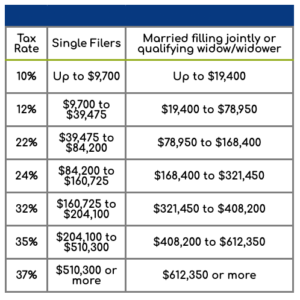

We showed John & Sarah the tax table below, and explained to them something we call “The Widow Tax”©

With their current level of annual income at $71,000, they fall squarely into the 12% tax bracket for married couples. With Required Minimum Distributions at age 70, Sarah would end up in the much higher tax bracket of 22% as a single widow if we did not act on this often overlooked Widow Tax© issue.

By showing John & Sarah a Social Security strategy, along with a tax reduction strategy for their IRAs, WMS turned John’s concern for Sarah’s well-being into surprised elation. Sarah would be able to have the same, if not more income at retirement once we implemented our suggested financial plan and some simple changes.

Case Study: The Widow Tax™

Spousal Loss leads to an Overbearing Uncle Sam

John & Sarah Raymond were retiring this year. John worked as the lead architect at a mid-sized firm for much of his career, and Sarah was a librarian at the high school their children attended and graduated from when they were younger.

When we met with the Raymonds, our initial meeting progressed as many do with an introduction to our firm and our staff, a discussion of the Wealth Management Solutions Investment Philosophy, and a request for insight into John & Sarah’s goals for retirement. After talk of travel and more time with grandkids, John became silent and paused to reflect on a concern that weighed heavily on his mind. Would Sarah be okay, financially, after he passed away?

Sarah would be able to have the same, if not more income at retirement once we implemented our suggested financial plan and some simple changes.

In addition to the $35,000 annual income from Social Security, John & Sarah also received $36,000 in annual income as a result of rental property they own and from dividends & interest from their taxable accounts. With John being 65 and Sarah only 58, they did not yet need to begin taking required minimum distributions from their IRAs. John believed Sarah would receive a reduced amount of Social Security if he died first.

We showed John & Sarah the tax table below, and explained to them something we call “The Widow Tax”©

With their current level of annual income at $71,000, they fall squarely into the 12% tax bracket for married couples. With Required Minimum Distributions at age 70, Sarah would end up in the much higher tax bracket of 22% as a single widow if we did not act on this often overlooked Widow Tax© issue.

By showing John & Sarah a Social Security strategy, along with a tax reduction strategy for their IRAs, WMS turned John’s concern for Sarah’s well-being into surprised elation. Sarah would be able to have the same, if not more income at retirement once we implemented our suggested financial plan and some simple changes.

-

Phone: 480.609.4334

Fax: 480.609.4335

-

General Inquiries:

-

Address

8550 E. Shea Blvd., Suite 130

Scottsdale, AZ 85260

-

Monday - Friday

9:00 am to 5:00 pm

Saturday & Sunday

Closed